DDPG Portfolio Manager

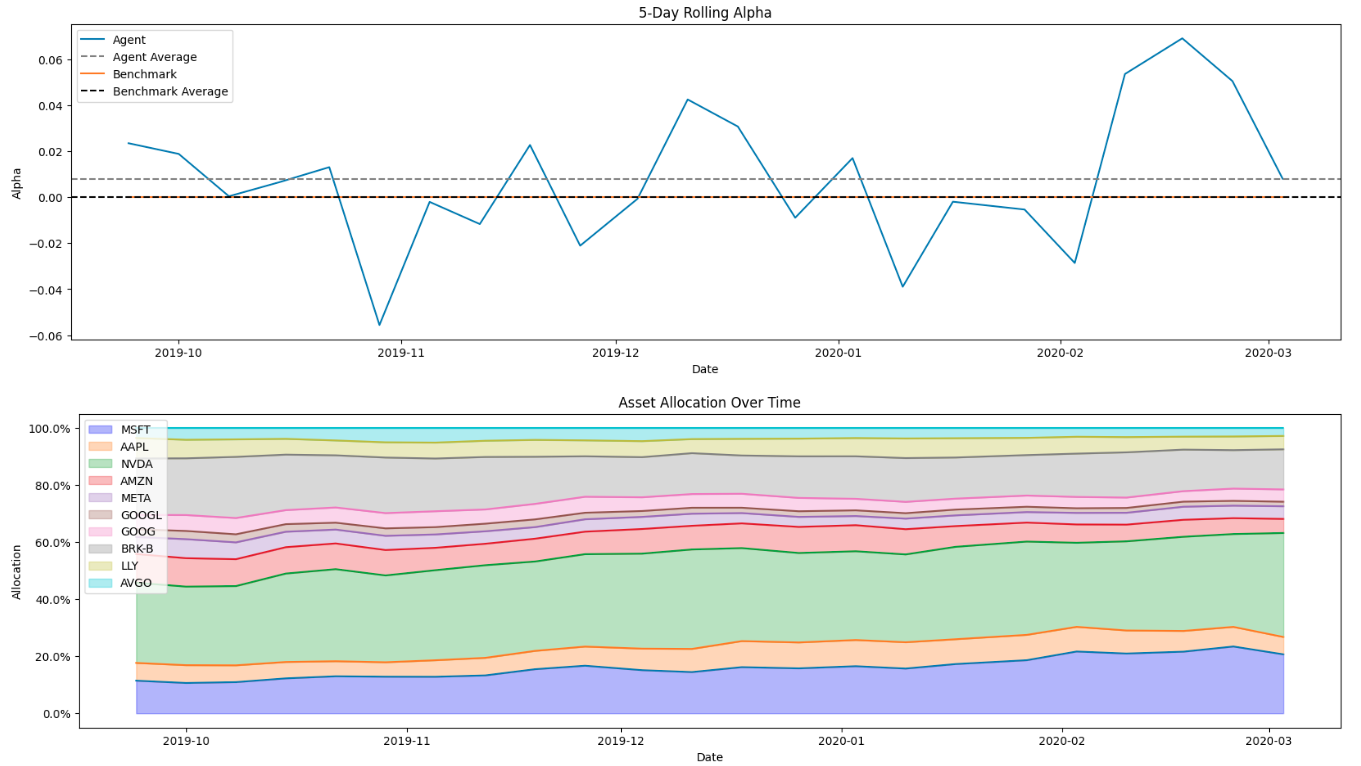

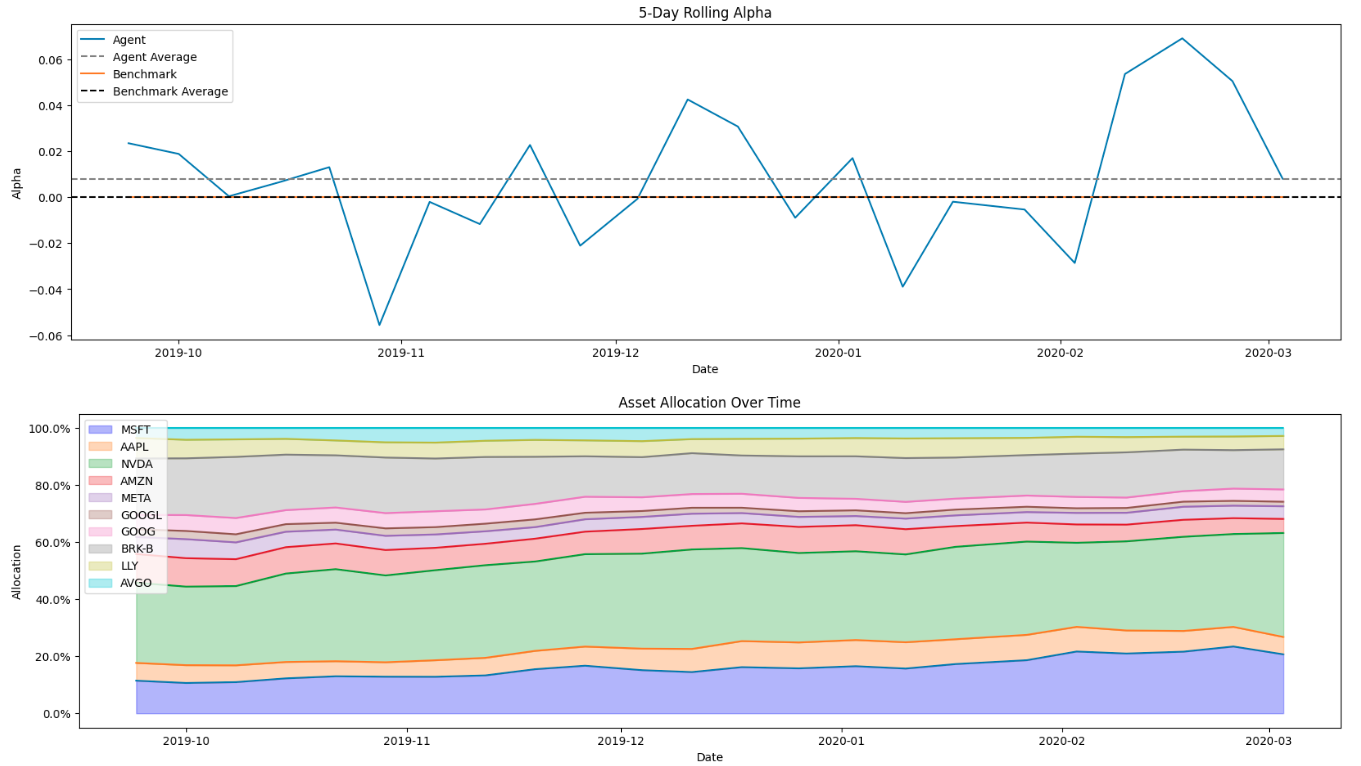

This repository is a data science project that implements the Deep Deterministic Policy Gradient (DDPG) algorithm on a customized stock trading market environment. This implements functionality for customizing the actor and critic networks, adjusting the (Ornstein-Uhlenbeck) noise, adding/pre-processing features through the implementation of a customized MarketData class, implements robust methods for training/testing of the algorithm, multi-GPU distributed training, and algorithm visualization in Plotly and Matplotlib. The data used in this demonstration has three main components: equity price candles, macroeconomic indicators, and the risk-free rate. All data used is from January 3, 2013 to February 1, 2024. The equity price candles are taken for the top 10 stocks (as weighted in the S&P 500). The macroeconomic indicators are the measures of 5-year breakeven inflation, 5-year forward inflation expectation, the federal funds rate, the 10- minus 2-year U.S. treasury spread and the CBOE Volatility Index (VIX). The risk-free rate is measured as the 3-month U.S. treasury bill.

Github Repository

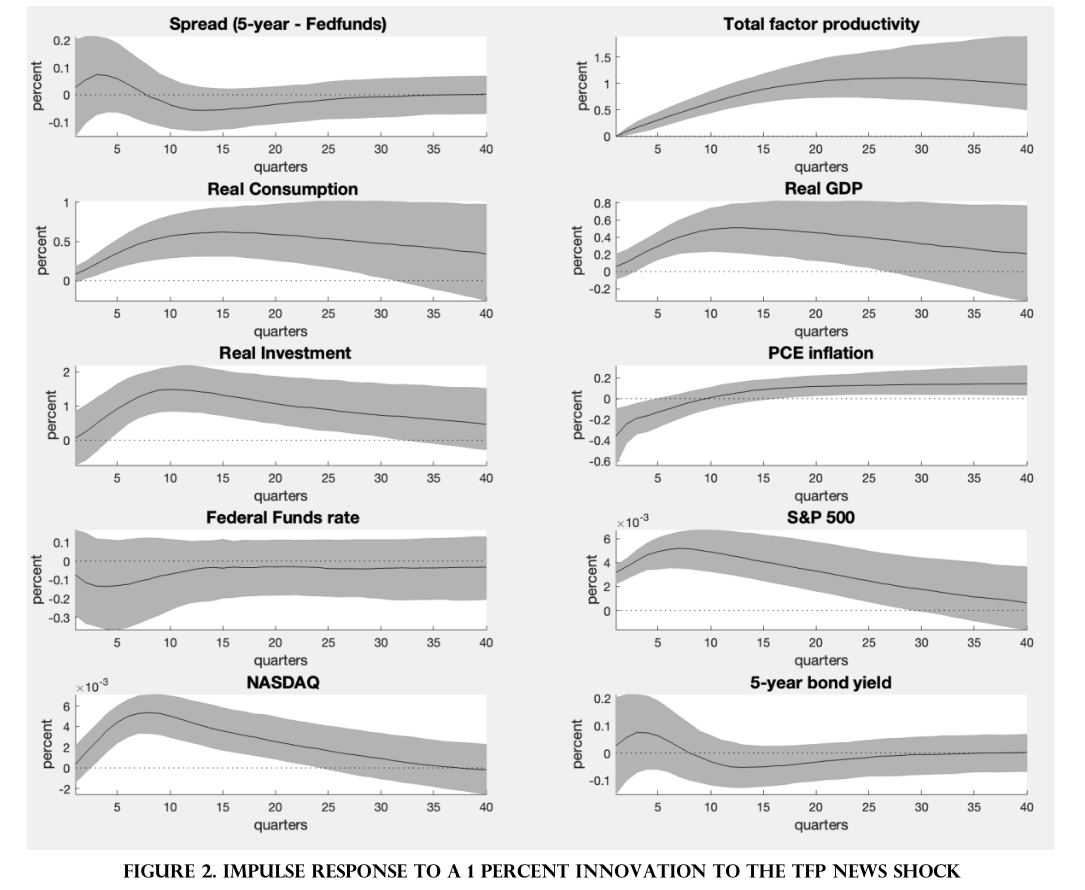

TFP News Shocks and Equity Markets

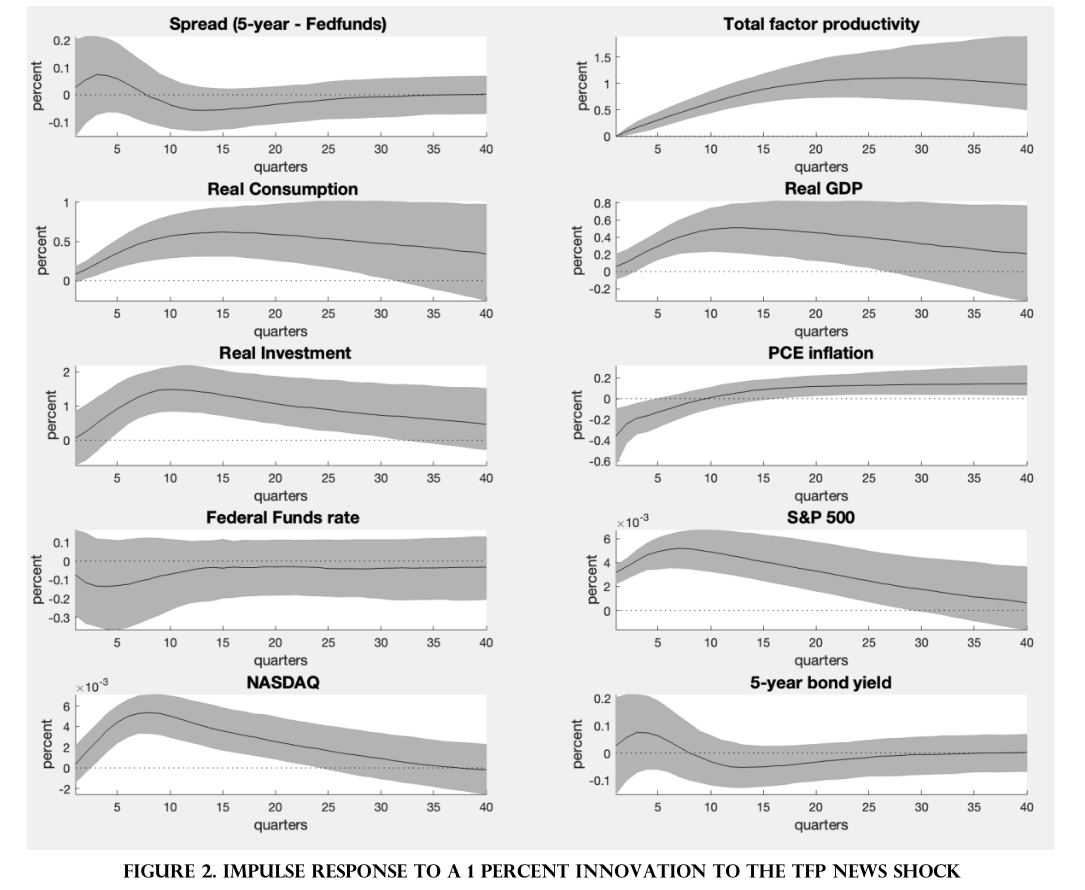

The stock market is often interpreted as the market capitalization of discounted expected future cash flows of constituent firms. While this topic has been extensively investigated in the context of an individual firm, the latent relationship between equity index performance and large-scale macro models remained mostly unexplored. Extending the 2013 study by Andre Kurmann and Chris Otrok, my paper finds that in a large vector auto-regression (VAR), shocks to future total factor productivity (i.e., TFP news shocks) can explain a significant proportion of residual variation in equity indexes and Fama-French 5-factor portfolios up to 10 years in the future. Moreover, this paper seeks to bridge the gap between models of aggregate economic productivity and the traditional asset-pricing literature.

Download the Paper (PDF)

LinkedIn Post

LSTM Iterative Price Prediction

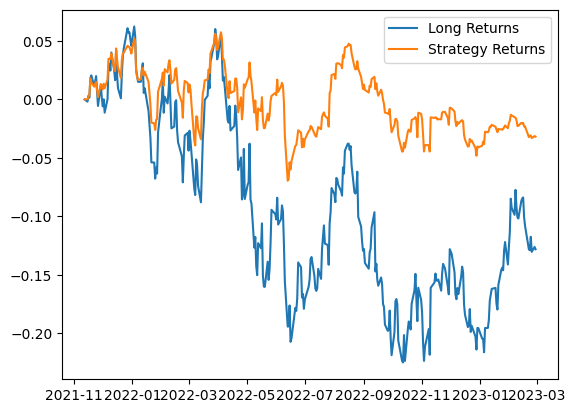

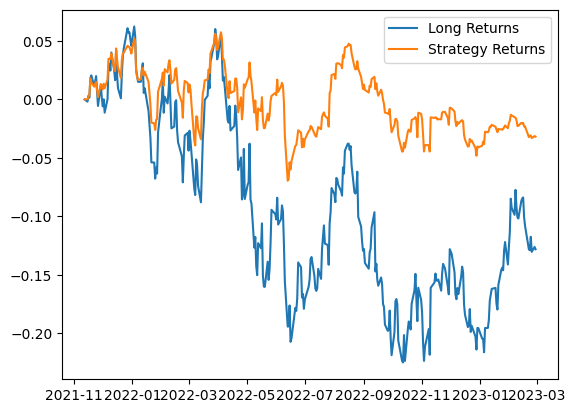

This repository presents a data science project aimed at constructing a portfolio that surpasses its benchmark through the utilization of neural networks featuring an LSTM layer in its architecture. The neural networks are provided with a matrix of data with dimensions (look_back, n_features), representing a sliding window of the previous look_back day's data. The objective is to predict the next day's close price of the stock. Key features include the adjusted close, volume, and two macroeconomic indicators: the VIX and the 3-month treasury rate. The dataset spans from July 7, 2009, to March 1, 2023. Following predictions, a strategy is devised wherein buying occurs when the network predicts an increase and selling when it predicts a decline. Portfolio weights are determined based on the prorated weights of the S&P 500. In our test set, the algorithm outperforms the long-only benchmark by 964 bps.

Github Repository